Funding a business with bad credit can be challenging, but it’s not impossible. Here are several options you can explore to secure funding, despite having a less-than-ideal credit score:

-

Microloans

Microloans are small loans, often from nonprofit lenders, designed to help small businesses or startups that may have difficulty qualifying for traditional bank loans. These loans usually have lower qualification requirements and may be more lenient regarding credit scores.

- SBA Microloan Program: The U.S. Small Business Administration (SBA) offers microloans up to $50,000. These are typically provided by community-based nonprofit lenders, and while your credit score is a factor, it is not the only consideration.

- Kiva: Kiva is a global micro-lending platform that offers interest-free loans up to $15,000. It’s focused on supporting underserved entrepreneurs, so even those with poor credit may have a chance.

-

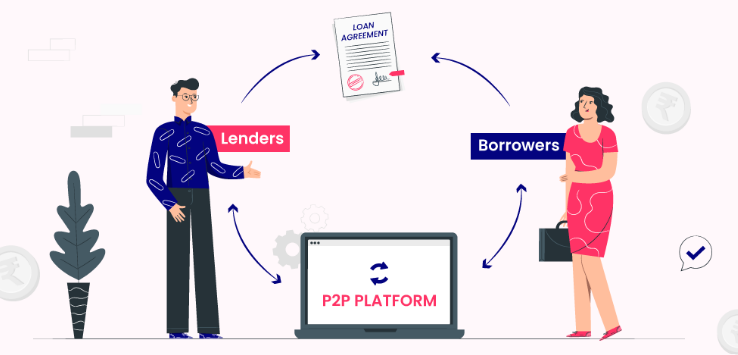

Peer-to-Peer (P2P) Lending

P2P lending platforms connect borrowers directly with investors. These platforms might be more flexible about credit scores than traditional banks and can offer a range of loan products. Keep in mind that interest rates may be higher, reflecting the increased risk to lenders.

- AmOne and Prosper are two popular P2P platforms that cater to small businesses, and while they will still assess your credit, they take other factors into account, such as business performance and revenue.

We ranked the 5 best sources for capital for your business. Click here to see the list and apply.

-

Alternative Lenders

Non-bank lenders, such as online lenders, often have less stringent credit requirements than traditional financial institutions. These lenders may offer business lines of credit, term loans, or other funding options.

- Fora Financial: For a Financial offers lines of credit based on your business’s cash flow, rather than personal credit scores.

- AmericanBusinessCapital.org: American Business Capital offers short-term loans and lines of credit to businesses with a minimum annual revenue, even if your credit score is lower.

- Bizvice: Bizvice has a ranking of the top alternative merchant cash advance lenders in the USA. Click here to see the ranking.

-

Personal Savings or Friends & Family

If you’re unable to secure funding through traditional channels, consider borrowing from personal savings or approaching friends and family for a loan or investment. This route can have less formal requirements but may come with risks in terms of relationships.

- Personal Loans: You might still be able to access a personal loan to fund your business if you have assets, such as a home or vehicle, to leverage as collateral.

- Friends and Family: While this option can be flexible, it can also strain personal relationships if the business doesn’t succeed. Be clear on the terms and risks before proceeding.

-

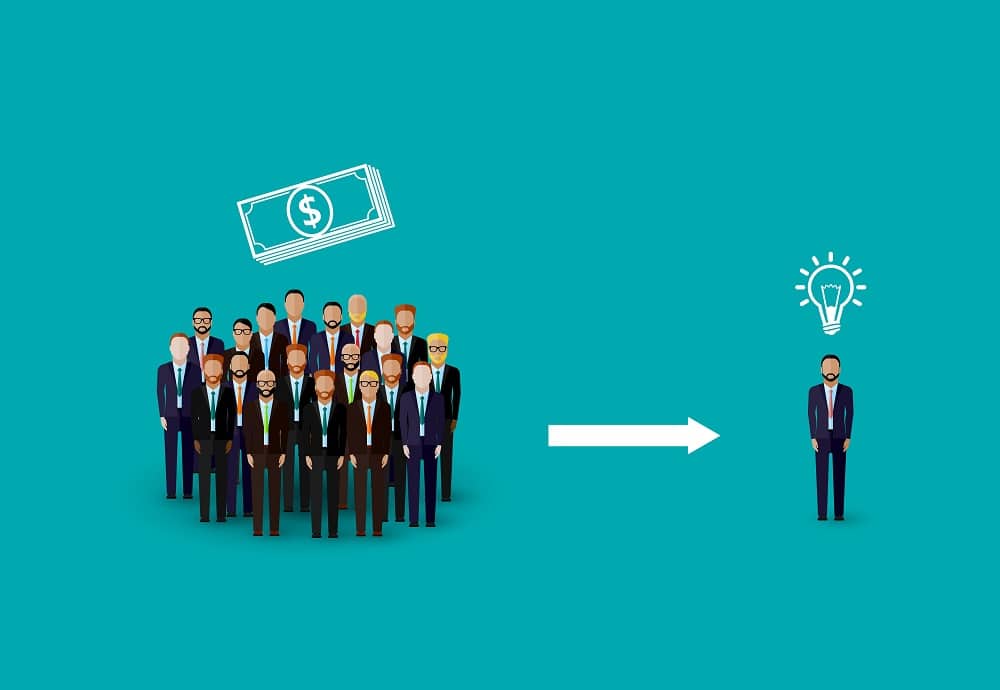

Crowdfunding

Crowdfunding platforms allow you to raise capital from a large number of individuals, often in exchange for rewards, equity, or a stake in your business. Crowdfunding is particularly popular for consumer-facing businesses, product innovations, and startups.

- Kickstarter and Indiegogo are two well-known platforms for raising funds from the public, typically in exchange for early access to products or rewards.

- Equity Crowdfunding: Platforms like WeFunder and StartEngine allow you to raise equity financing, where investors buy shares of your company in exchange for their investment.

-

Credit Lines or Business Credit Cards

If you have a business and are struggling with bad personal credit, consider applying for a business credit card or a business line of credit. These products may be easier to qualify for than traditional loans, especially if your business has been generating consistent revenue.

- Secured Business Credit Cards: If you have bad credit, secured cards (where you put down a deposit to secure a line of credit) may be a viable option.

- Business Lines of Credit: These are revolving credit lines that allow you to borrow up to a certain limit and pay it back as needed. Some lenders may be flexible about your personal credit score if your business has strong revenue and cash flow.

-

Grants

Though not a funding option you can always count on, business grants can provide non-repayable funding. There are various federal, state, and private grants that could be available to you, especially if you operate in certain industries or meet specific criteria (e.g., women-owned businesses, minority-owned businesses, or businesses that focus on sustainability).

- SBA Grants and Grants.gov can be good places to start looking for business grants.

Check out our guide on over 80 free to apply to grant programs by clicking here.

-

Seller Financing or Vendor Credit

If your business needs inventory or equipment, you might be able to secure financing directly from a supplier. Some suppliers offer vendor credit, allowing you to purchase goods on credit with deferred payment terms.

Similarly, seller financing can allow you to purchase equipment or property by arranging payments directly with the seller, sometimes with more favorable terms than a bank loan would provide.

-

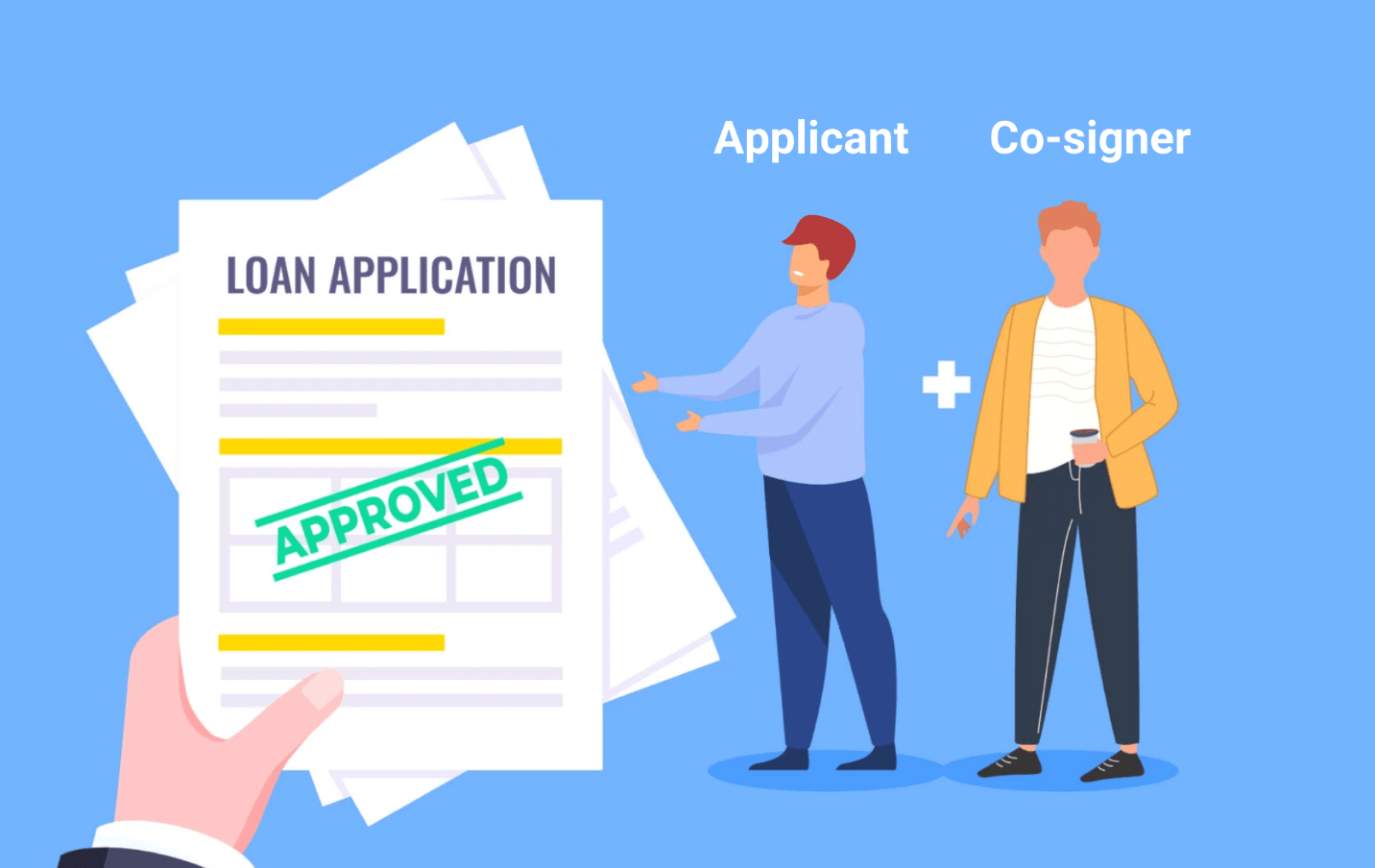

Consider Co-Signing or a Guarantor

If your credit is poor but you have a trusted business partner or someone with a stronger credit profile, they might be able to co-sign on a loan or provide a personal guarantee. This can increase the chances of approval and possibly secure better terms.

Key Considerations

- Interest Rates: Lenders may charge higher interest rates or fees if you have bad credit. It’s essential to understand the total cost of borrowing.

- Repayment Terms: Make sure the repayment terms are realistic for your business’s cash flow. Overextending yourself could lead to further financial problems.

- Loan Collateral: Some lenders may require collateral, like business assets or personal property, especially if your credit is poor.

Ultimately, while bad credit can limit some funding options, there are still a variety of alternative financing methods available for entrepreneurs. It’s important to shop around, understand the costs and risks, and ensure that the loan or funding option is a good fit for your business needs.

Pros

Pros

Cons

Cons

Funding Options

Funding Options