Securing a business line of credit with bad credit can seem like a difficult challenge, but it is far from impossible. A business line of credit provides flexible access to working capital, allowing you to withdraw funds as needed, up to a certain limit, and only pay interest on the amount you borrow. This financial tool is highly useful for managing cash flow gaps, covering short-term expenses, and funding everyday business needs. However, if your personal or business credit score is low, lenders may hesitate to approve your application.

- 1. Understand Your Credit Situation and Report

- 2. Consider Alternative Lenders for Business Lines of Credit

- 3. Prepare Your Business’s Financial Documentation

- 4. Offer Collateral to Secure Your Business Line of Credit

- 5. Consider a Co-Signer or Personal Guarantee

- 6. Start with a Smaller Credit Limit and Build Your Credit

- 7. Show Your Business’s Growth Potential

- 8. Build Your Business Credit for Future Financing

- 9. Use Your Business Line of Credit for Short-Term Needs

- 10. Pros and Cons of Getting a Business Line of Credit with Bad Credit

- 11. Conclusion: Getting a Business Line of Credit with Bad Credit

Despite these challenges, there are several steps you can take to improve your chances of qualifying for a business line of credit, even with a bad credit history. In this guide, we’ll walk you through the process and provide helpful tips on how to successfully obtain a business line of credit with bad credit.

-

Understand Your Credit Situation and Report

Before you start applying for a business line of credit, it’s essential to check your personal credit score and review your credit report. Most lenders will look at your personal credit score, as it is a key indicator of your financial responsibility. A score below 600 is often considered poor, and traditional lenders may be reluctant to approve you. However, some lenders are more flexible and may focus on other factors beyond your credit score.

- Check your credit score: Get your credit score for free from websites like Credit Karma or Experian. This will help you understand where you stand and what lenders may see when they pull your credit report.

- Review your credit report: Look for any inaccuracies or errors, as even minor issues can negatively impact your score. Correcting these errors can give your score a boost, increasing your chances of approval.

-

Consider Alternative Lenders for Business Lines of Credit

While traditional banks may require excellent credit to qualify for a business line of credit, alternative lenders can offer more flexible options for business owners with bad credit. These lenders often consider factors like your business’s cash flow, revenue, and overall financial health rather than just your credit score.

Some popular alternative lenders that specialize in business lines of credit for borrowers with bad credit include:

- Online lenders: Companies like Kabbage, OnDeck, BlueVine, and Fundbox are known for offering business lines of credit with more lenient credit score requirements. They often have faster approval processes and more relaxed qualifications than traditional banks.

- Peer-to-peer lending platforms: Platforms such as Funding Circle and LendingClub allow businesses to borrow from individual investors, which means there may be more flexibility regarding credit history.

- Community development financial institutions (CDFIs): These nonprofit organizations offer loans to small businesses in underserved communities and may be more open to working with business owners with bad credit.

-

Prepare Your Business’s Financial Documentation

To offset your bad credit, you’ll need to show potential lenders that your business is financially stable and capable of repaying the line of credit. Financial documentation is key in proving your business’s ability to repay borrowed funds. Make sure you have the following documents ready:

- Profit and loss (P&L) statement: A summary of your business’s revenues, costs, and profits over a specified period.

- Balance sheet: A snapshot of your business’s financial position, showing assets, liabilities, and equity.

- Cash flow statement: A report showing how cash flows into and out of your business, highlighting your ability to meet short-term obligations.

- Tax returns: Lenders may request the last 2-3 years of tax returns to assess your business’s financial history.

Strong financial documentation can help demonstrate your ability to repay the line of credit and provide a sense of security to lenders, even if your personal credit isn’t ideal.

-

Offer Collateral to Secure Your Business Line of Credit

If your credit is bad, offering collateral is one way to increase your chances of approval for a business line of credit. Collateral reduces the lender’s risk, as they can seize the pledged assets if you default on the loan. This might make lenders more willing to approve your application, even with poor credit.

- Business assets: Equipment, inventory, or real estate that your business owns.

- Personal assets: If your business assets are insufficient, you may need to pledge personal assets such as a vehicle, savings, or even your home.

It’s essential to carefully consider the risks of using collateral. While it can help secure financing, if your business is unable to repay the credit line, you could lose the pledged assets.

-

Consider a Co-Signer or Personal Guarantee

Another option to secure a business line of credit with bad credit is to offer a personal guarantee or find a co-signer. A personal guarantee is a commitment from you as the business owner to personally repay the debt if the business defaults. A co-signer is someone with better credit who agrees to take responsibility for the debt in case your business fails to repay the loan.

- Co-signer: If you can find someone with good credit (such as a business partner, family member, or friend), they may be willing to co-sign the loan, increasing your chances of approval.

- Personal guarantee: Keep in mind that offering a personal guarantee puts your personal assets at risk if your business fails to repay the debt. Lenders may require this if you have bad credit, so it’s crucial to assess the risks involved.

-

Start with a Smaller Credit Limit and Build Your Credit

If you have bad credit, consider applying for a smaller business line of credit at first. Lenders may be more likely to approve you for a lower credit limit since it poses less risk. As you prove your ability to manage the line of credit responsibly, you can gradually request a higher credit limit.

Additionally, if you’re just starting to build your business credit, a business credit card could be a good starting point. With responsible use, such as making timely payments and keeping your balance low, you can improve your business credit score over time, which may help you qualify for larger lines of credit in the future.

-

Show Your Business’s Growth Potential

When applying for a business line of credit with bad credit, it’s important to highlight your business’s growth potential. Lenders are more likely to approve businesses that show strong future prospects and the ability to generate steady revenue. Consider emphasizing the following aspects:

- Growing revenue: If your business is consistently increasing its revenue or has a solid track record of growth, this will help demonstrate your ability to repay the loan.

- Stable or expanding industry: If you operate in an industry that is growing or has stability, lenders may be more willing to approve your application.

- Strong customer base: A large and loyal customer base can be a significant indicator that your business will continue to generate revenue in the future.

Incorporating these elements into your business plan or application can help offset concerns about your credit score and demonstrate that your business is a good investment.

-

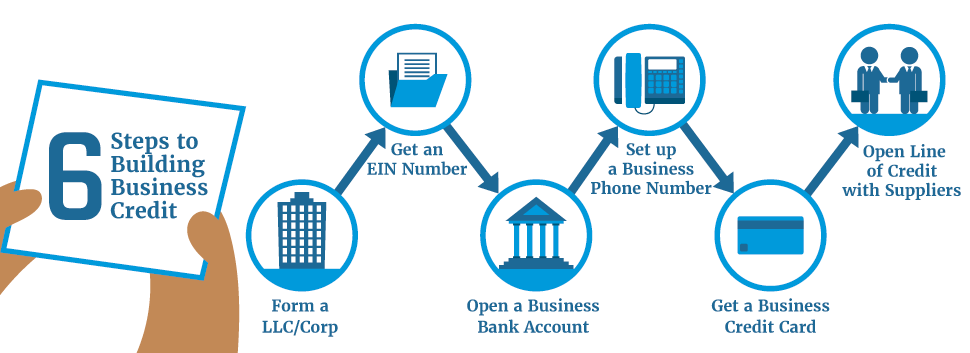

Build Your Business Credit for Future Financing

To make it easier to qualify for financing in the future, start building your business credit. Unlike personal credit, business credit is based on the financial history of your business and is independent of your personal credit. Here are some steps you can take to build strong business credit:

- Register with credit reporting agencies: Register your business with Dun & Bradstreet, Equifax, and Experian to establish a business credit profile.

- Apply for business credit cards: Using business credit cards responsibly can help build your business credit and improve your borrowing options over time.

- Establish trade credit: Work with suppliers and vendors who report your payments to business credit bureaus. Timely payments can help build your business credit score.

The stronger your business credit, the more likely you’ll be to qualify for future lines of credit and other financing options, regardless of your personal credit history.

-

Use Your Business Line of Credit for Short-Term Needs

If you successfully secure a business line of credit despite having bad credit, be strategic in how you use the funds. A business line of credit is ideal for short-term financing needs, such as covering cash flow gaps, managing seasonal expenses, or taking advantage of growth opportunities. Avoid using the credit for long-term investments that could be difficult to repay quickly.

Pros and Cons of Getting a Business Line of Credit with Bad Credit

Pros:

- Flexibility: A business line of credit offers flexible borrowing and repayment options. You only pay interest on the amount borrowed.

- Improved cash flow: Helps manage day-to-day expenses, unexpected costs, or temporary shortfalls.

- Builds credit: By using and repaying your line of credit responsibly, you can improve your business credit over time, which opens doors to better financing in the future.

Cons:

- Higher interest rates: If you have bad credit, lenders may charge higher interest rates than they would for borrowers with stronger credit.

- Collateral or personal guarantee: Some lenders require collateral or a personal guarantee, which can put your personal assets at risk.

- Lower credit limits: You may receive a smaller credit limit if you have bad credit, limiting your access to funds when needed.

Conclusion: Getting a Business Line of Credit with Bad Credit

While obtaining a business line of credit with bad credit can be more difficult, it is possible if you take the right steps. By understanding your credit situation, working with alternative lenders, offering collateral or a personal guarantee, and demonstrating your business’s financial stability, you can increase your chances of approval. Over time, as you build your business credit and prove your repayment ability, you’ll be in a stronger position to secure additional funding.

If you need a flexible financing solution and are committed to responsible borrowing, a business line of credit can be an excellent tool to support your business growth—despite having bad credit.

Pros

Pros

Cons

Cons

Funding Options

Funding Options