A Merchant Cash Advance (MCA) is a form of financing where a business receives a lump sum payment from a lender in exchange for a portion of its future credit card sales or daily revenue. Unlike traditional loans, an MCA is not a loan but an advance against future sales. The repayment structure is tied directly to the business’s daily credit card transactions or overall revenue, offering businesses flexibility when it comes to repaying the borrowed funds.

This financing option is often favored by small and medium-sized businesses, especially those with unpredictable or fluctuating revenue streams. Since businesses repay the MCA through a percentage of their daily or weekly sales, it’s a suitable solution for businesses in sectors such as retail, restaurants, and hospitality, where sales can vary significantly throughout the year.

In this article, we will explore the pros and cons of merchant cash advances, how they compare to other business financing options, and whether an MCA is the right solution for your business’s needs.

How Does a Merchant Cash Advance Work?

The process of obtaining a merchant cash advance is relatively straightforward. When a business applies for an MCA, the lender evaluates the business’s average daily credit card sales or overall monthly revenue to determine how much they can lend. Once approved, the business receives the cash advance and agrees to repay the amount through a fixed percentage of future credit card sales. This percentage is typically referred to as the holdback or repayment percentage.

Repayment Process:

The lender takes a portion of the business’s daily credit card transactions or revenue until the MCA is fully repaid. If sales are high, the repayments will be larger; if sales are low, the repayments will be smaller.

Typically, repayment is made daily or weekly, which can make it easier for businesses to handle during peak times, but challenging when sales drop.

Pros of a Merchant Cash Advance

- Quick Access to Capital: One of the main advantages of an MCA is the speed at which businesses can receive funds. Unlike traditional business loans, which can take weeks to process, an MCA can be approved and funded in just a few days. This is ideal for businesses that need fast access to cash to cover urgent expenses, such as inventory restocking, payroll, or emergency repairs.

- Flexible Repayment Terms: Since repayment is tied directly to daily sales, businesses don’t need to worry about fixed monthly payments. This flexibility allows businesses to pay back the MCA at a pace that aligns with their cash flow. When sales are strong, repayments will be larger; when sales are lower, repayments will be smaller. This flexibility can be especially helpful for seasonal businesses or businesses experiencing cash flow fluctuations.

- No Collateral Required: Many types of business loans require collateral (like property or assets) to secure the funding. However, merchant cash advances are typically unsecured, meaning businesses do not need to put up any physical assets as collateral. This makes MCAs accessible to businesses that don’t have valuable assets to pledge.

- Easier Qualification Criteria: The qualification process for an MCA is often more lenient than traditional loans. Lenders primarily focus on a business’s revenue and credit card sales history rather than credit score or business age. This makes MCAs a viable option for businesses with poor credit or those that are just starting out but have a steady stream of sales.

- No Fixed Repayment Schedule: Unlike traditional loans, which have fixed monthly payments, MCAs have a flexible repayment schedule. This means that businesses can manage repayments based on their sales performance. If business is slow, the repayments will automatically adjust, helping to ease the financial burden.

Cons of a Merchant Cash Advance

- High Costs and Fees: The biggest downside of an MCA is the high cost. While the flexibility is attractive, it comes at a price. Merchant cash advances often come with high factor rates, which can range from 1.1 to 1.5 or more. This means that businesses may repay more than the original amount borrowed—sometimes much more. The APR (Annual Percentage Rate) of an MCA can be significantly higher than traditional business loans, which makes it an expensive financing option over the long term.

- Daily or Weekly Repayments Can Strain Cash Flow: While the flexible repayment structure can help businesses manage cash flow during busy times, daily or weekly deductions can create challenges during slow sales periods. This constant drain on funds can leave a business with limited cash for other operational expenses, potentially leading to a cash flow crisis if sales don’t pick up.

- Short Repayment Periods: MCAs typically have short repayment periods, often ranging from 6 to 12 months. While this means businesses may be able to clear their debt quickly, it can also create financial pressure if the business is not able to generate sufficient revenue to meet the repayments in such a short time frame.

- Risk of Overleveraging: Because the MCA is based on future revenue and is relatively easy to qualify for, businesses may be tempted to borrow more than they can reasonably repay. If a business takes out too many advances, they may find themselves stuck in a cycle of debt, with a large portion of their daily sales going toward repayment, leaving little for operational expenses or profit.

- Lack of Regulation: Unlike traditional loans, the MCA industry is less regulated. This can expose businesses to predatory lending practices. Some lenders may charge exorbitant fees or provide unclear terms, making it crucial for businesses to read the fine print and fully understand the terms before committing to an MCA agreement.

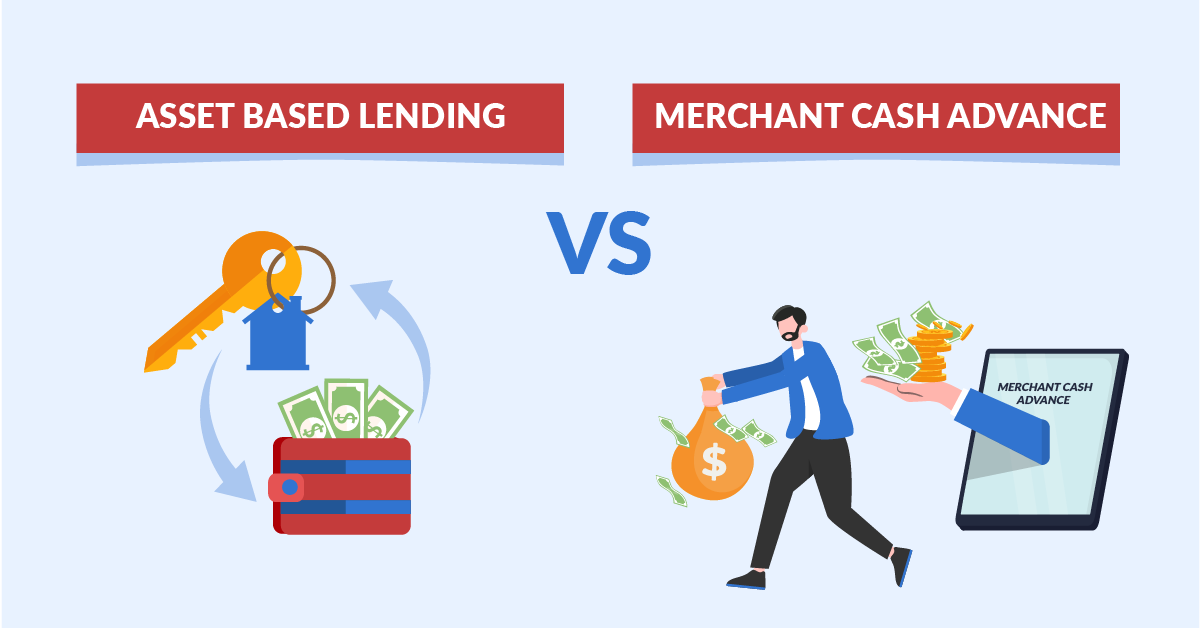

Merchant Cash Advance vs. Other Business Lending Products

When comparing a merchant cash advance to other business financing options, it’s important to understand the key differences in terms of structure, cost, and flexibility. Below is a breakdown of how an MCA compares to other common business funding solutions:

Business Term Loan vs. Merchant Cash Advance:

- Repayment Terms: Business term loans require fixed monthly payments over a set term, typically ranging from 1 to 5 years. In contrast, an MCA’s repayments are tied to sales and fluctuate depending on business performance.

- Qualification Criteria: Business term loans are generally harder to qualify for, requiring a strong credit score, stable financial history, and often collateral. MCAs are easier to qualify for, focusing more on daily sales or revenue than credit scores.

- Interest Rates and Fees: Business term loans tend to have lower interest rates and fees compared to the often high factor rates associated with MCAs. This makes traditional loans more affordable over the long term, especially for businesses with stable financials.

Business Line of Credit vs. Merchant Cash Advance:

- Flexibility: A business line of credit offers flexible access to funds that can be drawn upon as needed, with repayment based on the amount borrowed. With an MCA, businesses are required to repay a fixed percentage of daily sales, which can be less flexible.

- Cost: Lines of credit generally have lower interest rates and fees than MCAs, making them a more affordable financing option, especially for businesses that can manage their cash flow effectively.

- Collateral: While some business lines of credit require collateral, many are unsecured, making them similar to MCAs in this respect. However, lines of credit are often available with better terms for businesses that qualify.

Invoice Financing vs. Merchant Cash Advance:

- Collateral: Invoice financing involves borrowing against outstanding invoices, which businesses sell to the lender to receive an advance. MCAs, on the other hand, are based on future sales, not specific invoices.

- Repayment: Invoice financing is repaid when customers pay their outstanding invoices, while MCA repayments are made daily or weekly, based on credit card sales or overall revenue.

- Use Case: Invoice financing is more suitable for businesses that have significant accounts receivable but need immediate cash. An MCA is best for businesses with strong credit card sales who need capital quickly but are willing to pay high fees for fast access.

Is a Merchant Cash Advance Right for Your Business?

A merchant cash advance can be a helpful solution for businesses in need of immediate capital, especially those with high daily sales but poor access to traditional financing. The quick funding, easy qualification process, and flexible repayment terms make MCAs attractive, particularly for businesses in industries like retail, restaurants, or hospitality. However, the high costs and potential cash flow strain mean that MCAs should be used cautiously.

Before opting for an MCA, business owners should evaluate the total cost of the advance, the impact on daily operations, and whether there are better alternatives, such as business lines of credit, business term loans, or invoice financing. If a business can secure more affordable financing with lower repayment terms, that might be the better long-term option.

Pros

Pros

Cons

Cons

Funding Options

Funding Options