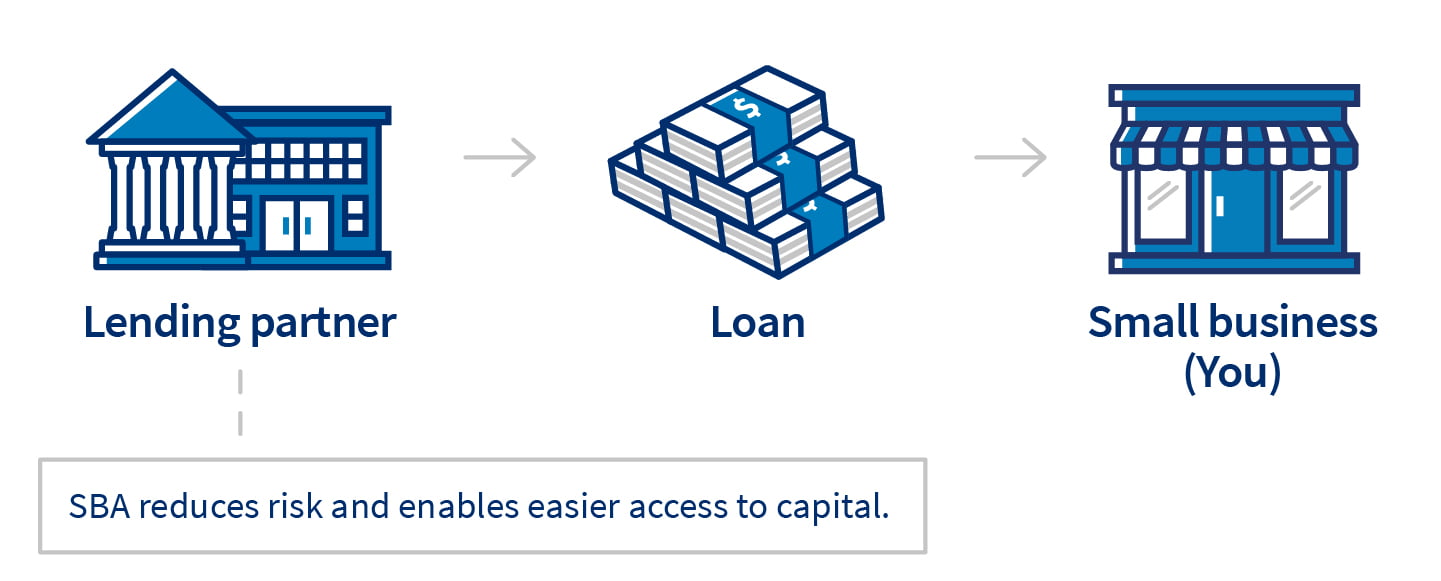

An SBA loan (Small Business Administration loan) is a government-backed financing option designed to help small business owners access capital on favorable terms. SBA loans are offered by approved lenders, including banks, credit unions, and online lenders, and are partially guaranteed by the U.S. Small Business Administration (SBA). This guarantee reduces the lender’s risk, making it easier for small businesses to qualify, especially those that may not have access to traditional business loans.

The SBA’s mission is to promote the growth of small businesses in the United States, and their loan programs are designed to make business financing more accessible and affordable. SBA loans come in several forms, including the 7(a)-loan program, the 504 loan program, and the Microloan program, each of which has specific eligibility requirements, loan terms, and usage guidelines. These loans are typically available for long-term investments, working capital, equipment purchases, and other business-related needs.

Types of SBA Loans

- 7(a) Loan Program: The 7(a)-loan program is the most popular and versatile SBA loan, designed for a wide range of business purposes. Small businesses can use these loans to purchase equipment, refinance debt, expand operations, buy real estate, or cover working capital. The 7(a) loan can provide up to $5 million in funding, with repayment terms up to 25 years, depending on the loan’s purpose.

- 504 Loan Program: The 504-loan program is primarily used for purchasing fixed assets like real estate, buildings, and large equipment. These loans can be as high as $5.5 million and are typically used by businesses that want to expand their facilities or invest in capital equipment. These loans come with long repayment terms, generally 10 to 20 years, and are structured to provide businesses with lower interest rates than they would typically receive with conventional financing.

- Microloan Program: The Microloan program provides smaller loan amounts, typically up to $50,000, to businesses in the startup phase or those that require small amounts of capital. Microloans are available through nonprofit community-based lenders and are often used for purchasing inventory, equipment, or other business needs. This program is particularly useful for entrepreneurs or small businesses that may not yet qualify for larger loans.

How Do SBA Loans Work?

SBA loans are not directly provided by the SBA but are instead issued by participating banks and other financial institutions. The SBA guarantees a portion of the loan, which reduces the risk for lenders and allows them to offer lower interest rates and longer repayment terms compared to traditional business loans.

- Loan Terms: SBA loans offer longer repayment terms (up to 25 years for real estate purchases), which lowers the monthly payment burden for borrowers.

- Interest Rates: SBA loans come with competitive interest rates, which are typically lower than those of conventional loans. These rates are capped by the SBA, ensuring that borrowers do not face excessive costs.

- Qualification: The qualification process for SBA loans involves reviewing the business’s credit score, financial health, and business plan. While SBA loans are easier to qualify for than traditional loans, businesses must still demonstrate solid financials, profitability, and the ability to repay the loan.

Benefits of SBA Loans

- Lower Interest Rates: One of the main advantages of SBA loans is their affordable interest rates. The SBA caps the rates, ensuring that business owners can access funding at lower costs than they would through traditional bank loans or other financing options. The lower interest rates make SBA loans an attractive choice for small businesses looking to minimize their debt burden.

- Longer Repayment Terms: SBA loans offer longer repayment periods compared to traditional business loans, typically up to 25 years for real estate loans. Longer repayment terms reduce monthly payments, which can help improve cash flow and make it easier for small businesses to manage their finances.

- Lower Down Payments: SBA loans generally require lower down payments compared to traditional bank loans. For example, SBA 7(a) loans may only require a 10% down payment, making them an ideal financing solution for businesses that may not have substantial upfront capital but need funding for growth.

- Flexible Loan Uses: SBA loans can be used for a wide range of business purposes, from purchasing inventory and equipment to expanding operations or refinancing existing debt. This flexibility makes SBA loans highly versatile and useful for a variety of business needs.

- Easier Qualification for New Businesses: Compared to conventional loans, SBA loans are often easier to qualify for, especially for startup businesses or those with less-than-perfect credit. The SBA’s guarantee reduces the lender’s risk, which makes lenders more willing to approve loans for businesses that may otherwise struggle to secure financing.

- Ongoing Support from the SBA: Businesses that obtain SBA loans often benefit from continued support and resources provided by the SBA, including counseling, training programs, and business development resources. This assistance can be invaluable to new business owners or those looking to expand their operations.

Drawbacks of SBA Loans

- Lengthy Application Process: The application process for SBA loans can be time-consuming, often taking several weeks or even months to complete. The process involves extensive paperwork, including business plans, financial statements, tax returns, and other documentation. This can be a challenge for businesses that need quick access to capital.

- Strict Eligibility Criteria: While SBA loans are easier to qualify for than traditional loans, they still have specific eligibility requirements. Businesses must meet minimum credit score thresholds, demonstrate profitability, and have a solid business plan. Startups or businesses with poor financial histories may struggle to meet these criteria.

- Collateral Requirements: Depending on the loan amount and purpose, SBA loans may require collateral to secure the loan. This can be problematic for small businesses that do not have significant assets to pledge as security. Collateral requirements can also increase the risk to business owners if the business is unable to repay the loan.

- Loan Amount Limits: Although SBA loans can provide substantial funding, they do have loan amount limits. For example, the maximum amount available under the SBA 7(a) loan program is $5 million. While this is often sufficient for small businesses, it may not be enough for larger businesses with greater capital needs.

- Closing Costs and Fees: SBA loans may have closing costs and fees that can add up. These can include application fees, packaging fees, and loan guarantee fees. While these fees are generally lower than those associated with conventional loans, they can still present a barrier for businesses with limited cash flow.

- Personal Guarantees: Many SBA loans require business owners to sign personal guarantees, which means the owner is personally liable for the loan if the business defaults. This increases the personal financial risk for business owners and can be a concern for entrepreneurs who do not want to jeopardize their personal assets.

SBA Loan vs. Other Small Business Lending Options

When comparing SBA loans to other types of small business financing, it’s essential to understand the differences in terms of cost, qualification, and flexibility. Here’s how SBA loans stack up against some common alternatives:

1. SBA Loan vs. Traditional Bank Loan:

- Interest Rates: SBA loans generally offer lower interest rates than traditional bank loans, making them a more affordable financing option.

- Qualification Criteria: SBA loans are easier to qualify for than traditional bank loans, especially for businesses with less-than-perfect credit or limited financial histories.

- Repayment Terms: SBA loans tend to have longer repayment terms (up to 25 years), whereas traditional bank loans may have shorter repayment periods, increasing monthly payments.

2. SBA Loan vs. Business Line of Credit:

- Flexibility: A business line of credit offers revolving access to funds, meaning businesses can withdraw money as needed, up to a set credit limit. SBA loans provide a lump sum of funding with fixed repayment terms, making them less flexible than lines of credit.

- Qualification: SBA loans require more documentation and a longer approval process, while business lines of credit can often be approved more quickly, especially for businesses with good credit.

- Interest Rates: SBA loans typically offer lower interest rates than business lines of credit, but lines of credit provide more immediate access to funds.

3. SBA Loan vs. Merchant Cash Advance (MCA):

- Cost: Merchant cash advances (MCAs) are much more expensive than SBA loans, with high factor rates and daily or weekly repayment schedules based on future sales. SBA loans come with lower interest rates and longer repayment terms, making them more affordable in the long run.

- Repayment: MCAs are repaid daily or weekly, which can put a strain on cash flow, especially for businesses with fluctuating sales. SBA loans have fixed monthly payments, providing more predictability in repayment.

- Qualification: MCAs are easier to qualify for than SBA loans, as they are based on future sales rather than credit scores and financial health.

4. SBA Loan vs. Invoice Financing:

- Loan Use: Invoice financing is specifically designed for businesses with outstanding invoices. It allows businesses to borrow against those unpaid invoices for immediate cash flow. SBA loans can be used for a broader range of purposes, including expansion, working capital, and equipment purchases.

- Cost: Invoice financing can be more expensive than SBA loans, especially if invoices take a long time to be paid. SBA loans offer more favorable terms, making them a better choice for long-term financing needs.

Conclusion: Is an SBA Loan the Right Choice for Your Business?

An SBA loan can be an excellent financing solution for small business owners who need affordable, long-term funding with favorable terms. With low interest rates, long repayment periods, and flexible loan uses, SBA loans are an attractive option for businesses that meet the eligibility requirements. While the application process can be lengthy and the requirements stringent, the benefits of an SBA loan often outweigh the challenges—especially for businesses looking to grow, expand, or invest in the future.

If you’re considering applying for an SBA loan, it’s essential to assess your business’s needs, financial health, and long-term goals. Compare the SBA loan to other financing options to ensure you choose the best solution for your business.

Pros

Pros

Cons

Cons

Funding Options

Funding Options