Are you owed an SETC Tax Credit?

You’re probably wondering why your accountant or tax filing service didn’t file the SETC Tax Credit for you. It would make sense the tax professionals wouldn’t miss a tax credit this big, but they did.

Want to file and claim your refund before it’s too late? Click here for more details on how to hire a recovery agent who can get those funds back for you.

During Covid-19 with lockdowns and more confusion than not. The government rushed through a lot of packages for relief but as the covid pandemic went on lawmakers realized they provided relief for business owners, and employees but left out the independent contractors or 1099 workers.

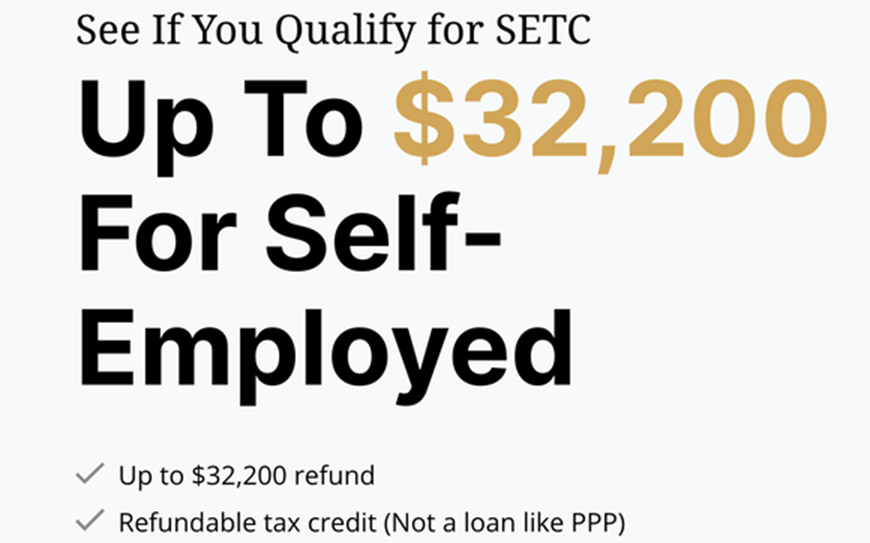

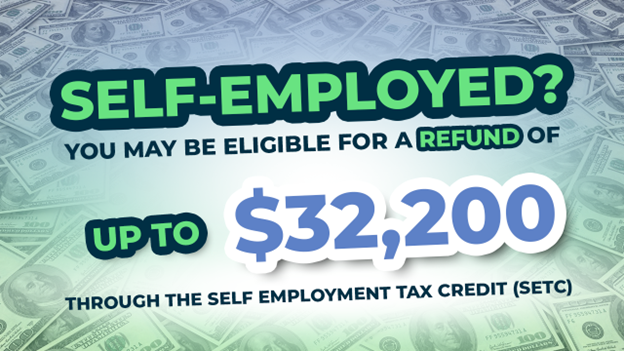

Thos who file a form SE or Schedule C with their taxes were left with no Covid relief funds, so in 2021 when congress passed the FFCRA (Families First Corona Virus Relief Act) they included a tax credit of $32K per person for 2020 and 2021, problem is for 2020 most people already filed their taxes by the time this credit passed, and for 2021 of the software platforms accountants and tax services use didn’t have the time to add this credit to their questions, so most didn’t get it.

Unfortunately, the ability to go back in time and claim the tax credit for 2020 expired on April 2024, and the ability to go back and recover the refund owed independent contractors for 2021 expires in April 2025.

Delaying can be costly, when you were able to go back and file for both years the average check amount was close to $16K, now with just the one year left the amount is closer to $9K on average

Are you eligible for the SETC tax credit?

Click here to see if you qualify and how to recover up to $34K in refunds owed to you.

Click HereNot sure if you qualify?

Click here and check the qualifications for filing.

Want to file and claim your refund before it’s too late? Click here for more details on how to hire a recovery agent who can get those funds back for you.

You can recover this lost money very easily by working with a tax recovery expert who can get you back every penny you’re owed. To find a qualified expert in the SETC tax credit click here

Learn more about the SETC tax credit

- What is the 1099 SETC Tax Credit?

- Is the 1099 SETC Tax Credit a Scam?

- Do You Qualify for the SETC Tax Credit?

- How Much Time Is Left to Apply for the SETC Tax Credit

- How Do I Apply For the 1099 Worker SETC Tax Credit

You could be owed $1000’s by the IRS

If you filed a Schedule C or form SE with your 2020 or 2021 taxes

Click here now to see how you can claim this refund.

Click Here

Pros

Pros

Cons

Cons

Funding Options

Funding Options