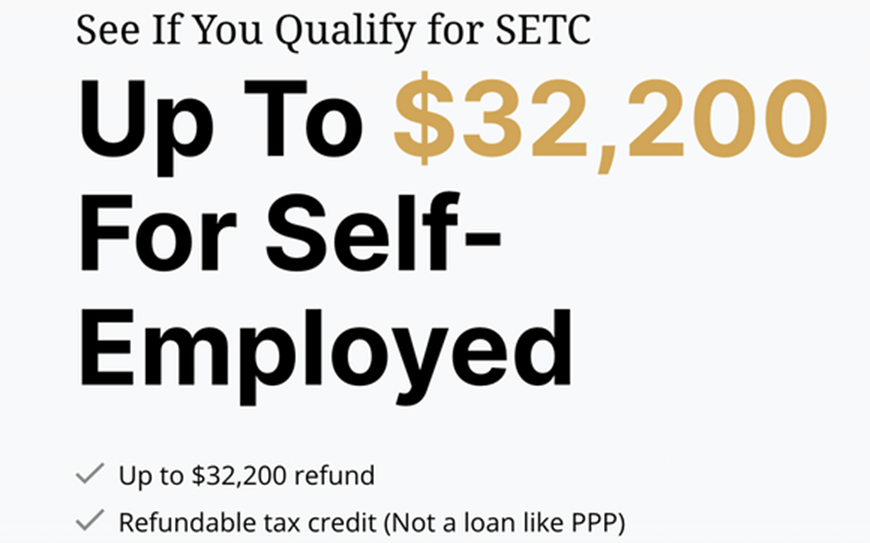

Are you owed an SETC credit?

Do you qualify for the SETC Tax Credit? Well, if you worked as an independent contractor, 1099 worker, uber driver, door dash driver, or any other position that required you to file a Schedule C or Form SE with your 2020 or 2021 taxes then you might be.

The amount you qualify for will be determined, off your prior year’s earnings, if you have kids, and how many days you missed work due to covid sickness or restrictions.

Are you eligible for the SETC tax credit?

Click here to see if you qualify and how to recover up to $34K in refunds owed to you.

Click HereThe Details

This tax credit repays you for time missed from working due to covid illness in certain situations. If you have kids and were unable to work due to virtual school and having to care for a minor, you could be eligible. If you missed work due to sickness or quarantine you could be eligible.

The amount you are paid each day is determined by your daily earnings from the previous year, which means that your current daily pay rate is directly influenced by how much you earned per day during the last year.

Not sure if you qualify for the SETC Tax Credit? Click here and check the qualifications for filing.

Want to file and claim your refund before it’s too late? Click here for more details on how to hire a recovery agent who can get those funds back for you.

You can recover this lost money very easily by working with a tax recovery expert who can get you back every penny you’re owed. To find a qualified expert in the SETC tax credit click here

Learn more about the SETC tax credit

- Is the 1099 SETC Tax Credit a Scam?

- What is the 1099 SETC Tax Credit?

- How Much Time is Left in The SETC Tax Credit?

- Why Did My Accountant Not File for The SETC Tax Credit Already?

- How Do I Apply For the 1099 Worker SETC Tax Credit?

You could be owed $1000’s by the IRS

If you filed a Schedule C or form SE with your 2020 or 2021 taxes

Click here now to see how you can claim this refund.

Click Here

Pros

Pros

Cons

Cons

Funding Options

Funding Options